As we bid adieu to 2012, it’s almost 2 years that 3g started rolling out in India. Despite significant price correction of nearly 70%, 3G Data rates yet hover above at an average 2.5 times of 2G GPRS Data packages. This indicates that there is room for further price cuts in 3G services. The key differentiating factor between 2G and 3G is speed implying consumer’s data usage is not depended on 3G technology. While high bandwidth data usage is inconvenient on 2G, 2.5x rates differentials between 2G and 3G are too high to capture data users on 3G and monetise high asset creation in 3G.

As we bid adieu to 2012, it’s almost 2 years that 3g started rolling out in India. Despite significant price correction of nearly 70%, 3G Data rates yet hover above at an average 2.5 times of 2G GPRS Data packages. This indicates that there is room for further price cuts in 3G services. The key differentiating factor between 2G and 3G is speed implying consumer’s data usage is not depended on 3G technology. While high bandwidth data usage is inconvenient on 2G, 2.5x rates differentials between 2G and 3G are too high to capture data users on 3G and monetise high asset creation in 3G.

Globally 3G penetration has been led by low price arbitration between 2G and 3G. Until data prices are aligned for both technologies, operators will find it difficult to expand 3G services at a mass level. Indian Telecom operators on the contrary are signalling increase in 2G rates to align it with 3G rates. We believe the low data penetration rates will force companies to keep data rates low for a long period to enhance subscriber base.

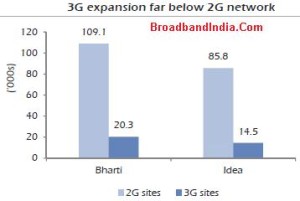

Coverage of 3G in India vs 2G

As evident from the Chart above, with nearly 2 years from commencement of 3G operations, telecom operators have about 16%-17% of network coverage vs 2G network, which implies that there is vast unutilized network inorder to create a base compared to 2G network. Operators have expanded network in large cities, however, it remains far below the 2G network.

Airtel and Idea have guided that the front ended 3G capex will slowdown, we believe they are far from the high capex mode as 3G network will require to be ramped up significantly in order to enhance penetration rates. Airtel on the other hand has the challenge to build 4G footprint as well. It is safe to conclude that, in order to increase data usage and penetration rates, operators will need to increase coverage to expand data penetration rates.